#stocks day trader

Explore tagged Tumblr posts

Text

#day trading#futures trading#investing#investors#investments#finance#personal finance#financial literacy#volumeprofile#marketprofile#order flow#trader#stock market#emini

11 notes

·

View notes

Text

The Shocking Myth About Trading Everyone's Been Fooled By!

Honestly, when I first started learning about trading, I believed what most people still do:

To succeed, you have to predict the market. It sounded so logical, right? If you can see where the market is headed, you’ll win every time. But here’s the truth this is one of the biggest myths that keeps so many people stuck, frustrated, and, frankly, losing money.

In fact, trying to predict every single market move is not just impossible but also harmful to your success. I genuinely want to help you avoid falling into this trap because I’ve seen how damaging it can be. Let me walk you through why this myth persists, why it’s wrong, and how you can take a better approach to trading.

The Truth Behind the Myth: Why It’s Holding You Back

Let’s be real I wouldn’t want to be the genius trader who perfectly predicts the market? But the harsh reality is that no one can do it. Not even the experts. This myth thrives because it gives people false hope, but here’s why it’s such a problem:

It creates unrealistic expectations: You expect every trade to be a win, and when it’s not, you feel like a failure. But trading doesn’t work like that.

It encourages risky behavior: Believing in predictions can push you to take impulsive, high risk trades. Honestly, that’s a dangerous mindset.

It shifts focus from the essentials: Instead of learning valuable skills like risk management and strategy, traders waste time chasing something that’s not achievable.

What Successful Traders Actually Do

Now, here’s where the real magic lies. The best traders don’t focus on predicting the future they focus on mastering the things they can control.

Risk Management: This is genuinely the foundation of success. Great traders know that losing some trades is normal. What matters is minimizing losses and maximizing wins over time.

Consistency Over Perfection: Rather than chasing predictions, successful traders follow a clear plan that works in the long term.

Emotional Discipline: Let’s be honest trading stirs up emotions. But staying calm and making decisions based on strategy, not feelings, is what sets winners apart.

How to Succeed Without Chasing Predictions

I know you want real, actionable advice, so here’s a simple plan to set you on the right path:

1. Learn, Learn, Learn: In fact, knowledge is your greatest tool. Study market trends, explore strategies, and genuinely understand how trading works.

2. Start Small: Try the waters with small investments or demo accounts. This approach is ideal for building confidence without risking too much.

3. Set Realistic Goals: Honestly, expecting overnight success will only discourage you. Focus on small, steady progress instead.

4. Stay Updated: The market is always evolving. Keep yourself informed and adjust your strategy as needed.

Let’s Wrap This Up

Trading isn’t about predicting every market move it’s about building a strategy that works, managing risks, and staying consistent. Honestly, when you stop chasing the impossible and start focusing on what really matters, that’s when you’ll see true progress.✨

Tell me honestly in your trading journey, have you ever believed in this myths?

Comment ‘Yess’ or ‘No’ below I’m curious to know

Stay blessed 😊

#stock market#trading success#cryptocurrency#financialfreedom#trading tips#stock trading#tradingskills#forex traders#learntotrade#stockmarkettips#investmentstrategies#tradingmindset#cryptotrading#day trading#forex trading for beginners#riskmanagement#hardworkpaysoff

2 notes

·

View notes

Photo

#paris 2024#olympics#shooting#turkey#south korea#stock market#day traders. dollar cost averaging#index funds#crash

4 notes

·

View notes

Text

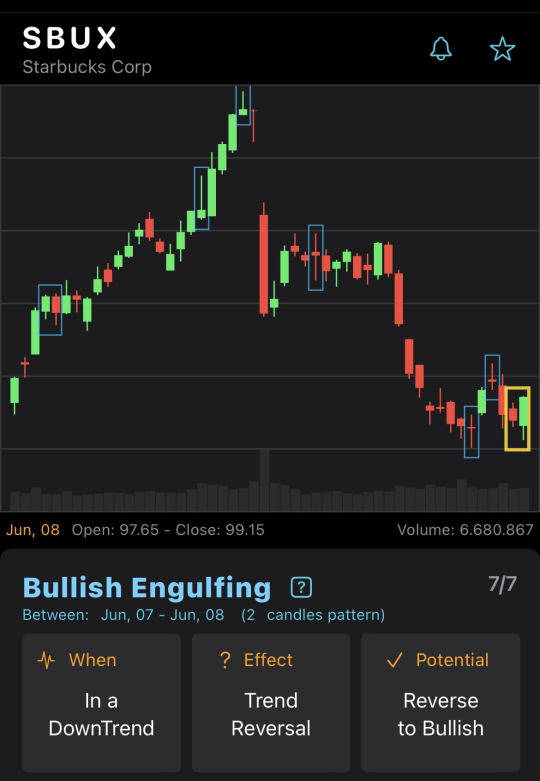

Bullish Engulfing on SBUX chart

BullishEngulfing CandleStickPattern on SBUX end-of-day chart on Jun, 08. Potential reverse to bullish.

7 notes

·

View notes

Text

THE BEST MT4 SYSTEM

+656 Pips Profit with “Exynox Scalper” (+5 FRESH Screenshots)

It looks like you are missing out... Lots of Traders have already made hundreds of pips with brand new “Exynox Scalper” by Karl Dittmann.

It's easy, it’s accurate and it keeps generating amazing winning trades. Just look at these fresh screenshots: See New Screens with Open Trades

I highly recommend you get your own copy of “Exynox Scalper” and finally start making easy high profit with us: www.ExynoxScalper.com

#day trading#day trading for beginners#how to day trade#stocks#forex#crypto#how to trade stocks#learn to trade#how to trade#learn to day trade#how to day trade for beginners#day trader#how to get started day trading#day trade#how i learned to day trade#learn how to day trade#how to trade stocks for beginners#how i learned to day trade in a week#books to learn how to trade#learn how to trade#how to day trade stocks#how to trade forex in 2023

5 notes

·

View notes

Text

#day trading#futures trading#investing#investors#investments#finance#personal finance#financial literacy#volumeprofile#marketprofile#order flow#trader#stock market#emini

4 notes

·

View notes

Text

The Dark Side Of Trading No One Talks About Until It’s Too Late

When I initially started trading, I was delighted and perhaps a touch overconfident. The thought of working on my own terms and earning money from anyplace looked appealing. But, honestly, reality struck me hard. Trading isn't as straightforward as it's frequently made out to be, and there are so many things I wish I had known before starting. If you're new to this world, allow me to share some painful facts that I had to learn the hard way.

The Illusion of Quick Success

Trading is frequently marketed as a simple way to financial independence, but in reality, it is the opposite.

It takes real time and effort:

Successful trading needs attention, education, and practice. Nobody becomes a successful trader overnight, regardless of what social media portrays them.

Losses are unavoidable: Even the most successful traders lose money. The difference is that they understand how to handle them and learn from their mistakes. If you're in business for the long run, prioritize constructing a solid foundation above chasing immediate gains.

Emotions can be a hindrance to successful trading.

Fear and greed rule: fear may prevent you from seizing lucrative possibilities, but greed might lead to rash judgments.

Discipline is needed: Staying calm and disciplined, especially during market turbulence, is what distinguishes great traders from the competition. Take breaks when you're feeling overwhelmed. An uncluttered mind can make wiser decisions.

Hidden Costs You Don't Expect:

Trading is more than simply investing money in the market. There are other charges that may catch you off guard.

Fees and commissions: Every deal incurs fees, which mount up over time. Make sure to factor in this when calculating your profits.

Education and tools: Whether it's classes, software, or dependable data platforms, these are important but often expensive prerequisites for professional traders.

Being aware of these fees can help you avoid unreasonable expectations.

The Mental Pressure is Real: Trading is not just financially tough; it can also have a negative impact on your emotional health. Volatile markets can cause stress, making you worried and on edge. Having a plan in place can help alleviate the tension.

Loneliness of the journey: Unlike other vocations, trade is generally done alone. Creating a community of like minded individuals may truly help you stay motivated and supported.

Remember that taking care of your emotional health is equally vital as learning technical analysis.

Importance of a Clear Strategy:

Trading without a plan feels like driving without a map; you'll get lost quickly. Backtest your strategy: Before putting your hard earned money at jeopardy, be sure your methods work by testing them against previous data.

Focus on consistency: Small and regular gains are considerably preferable to chasing risky, huge wins. Your strategy should be your guide, and following it is critical for long term success.

Final Thoughts

Trading is a journey, and like any journey, it presents hurdles. The dark side exists, and if you are not prepared, it can have serious consequences. However, if you are disciplined, patient, and eager to learn, the rewards are well worth it.

Tell me honestly, have you ever faced any of these challenges in your trading journey? Share your thoughts & experiences in the comments I’m really waiting to know your stories.

"We're Building This Together"

Success is more meaningful when we achieve it together, with each shared story and learned lesson. This is more than just trading knowledge it’s about building a supportive community where we can openly share advice, experiences, and encouragement.

Your story could truly encourage someone else who is struggling on their journey!

Remember, each of you brings unique value and respect to this community, and I’m really grateful to have you here. Let's keep learning, growing, and achieving success together.

Your shared experiences, with all their ups and downs, encourage us all.

Together We're not just a community; we're a family, always standing by each other, no matter what comes our way.

Stay blessed 👍

#stock market#cryptocurrency#financialfreedom#trading success#learntotrade#trading tips#stock trading#tradingskills#forex traders#trading strategies#day trading#hardworkpaysoff#cryptocurreny trading#trading psychology#tradingprofit#tradesmart#longtermsuccess#tradingmindset#tradingjourney#investmentstrategies

1 note

·

View note

Text

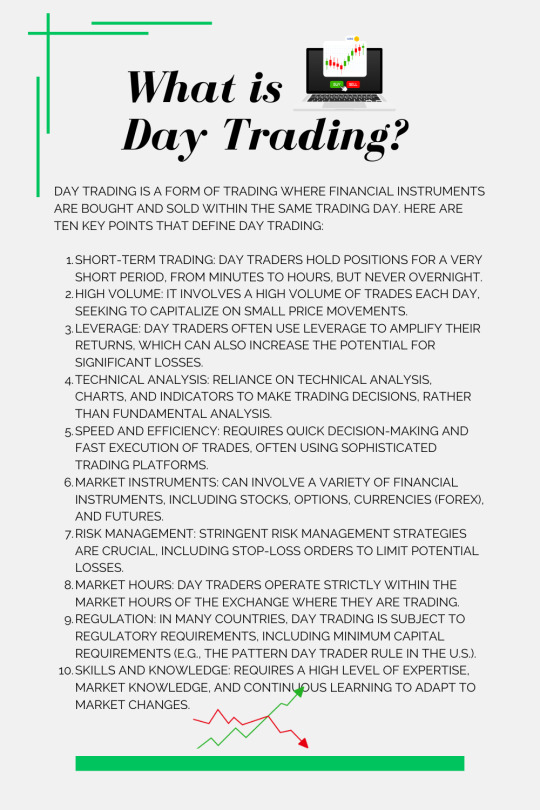

What is Day Trading: You Need To Know!

Day trading is a form of trading where financial instruments are bought and sold within the same trading day. Here are ten key points that define day trading:

Short-Term Trading: Day traders hold positions for a very short period, from minutes to hours, but never overnight.

High Volume: It involves a high volume of trades each day, seeking to capitalize on small price movements.

Leverage: Day traders often use leverage to amplify their returns, which can also increase the potential for significant losses.

Technical Analysis: Reliance on technical analysis, charts, and indicators to make trading decisions, rather than fundamental analysis.

Speed and Efficiency: Requires quick decision-making and fast execution of trades, often using sophisticated trading platforms.

Market Instruments: Can involve a variety of financial instruments, including stocks, options, currencies (forex), and futures.

Risk Management: Stringent risk management strategies are crucial, including stop-loss orders to limit potential losses.

Market Hours: Day traders operate strictly within the market hours of the exchange where they are trading.

Regulation: In many countries, day trading is subject to regulatory requirements, including minimum capital requirements (e.g., the Pattern Day Trader rule in the U.S.).

Skills and Knowledge: Requires a high level of expertise, market knowledge, and continuous learning to adapt to market changes.

Do you want to learn trading education and read the Review of Institute of Trading and Portfolio Management (ITPM)

#Day Trading#Day Traders#Day Trading Basics#What is Day Trading#Trading Education#Financial Education#stock market#traders#investment#learning

1 note

·

View note

Text

youtube

Dumb Money (2023) | Ending Credits

Title Design by Jeff Kryvicky @ COLLIDER STUDIO NYC

#Dumb Money#Movie#film#hollywood#day trader#investment#stocks#wall street#wallstreetbets#reddit#social networks#social media#internet#meme stock#penny stocks#day trade#Title Design#Youtube#typography#graphic design#motion graphics

1 note

·

View note

Text

0 notes

Text

0 notes

Text

#day trading#futures trading#investing#investors#investments#finance#personal finance#financial literacy#volumeprofile#marketprofile#order flow#trader#stock market#emini

3 notes

·

View notes

Text

Surviving the Ups and Downs: My Toughest Journey to Thriving in Trading Without Losing My Mind

Let's be honest, trading is more than just analyzing data. It's a challenging journey, both emotionally and mentally. Some days you feel on top of the world, while others you question whether it's all worth it. I've been there more times than I can count, and it is not easy. In fact, through all of the ups and downs, I've learned that it's not the market that defines your success, but how you manage your thinking.

Over time, I've learned how to navigate the chaotic world of trading without losing my mind.

Emotional Rollercoaster

A Trader's Reality:

Anyone who has ever traded understands that there will always be ups and downs. At first, I assumed it was all about profitable trading and watching my wealth increase. But I immediately discovered there was a lot more to it. The market, like life, is unpredictable, and it may be a difficult emotional experience at times.

Why Emotional Control Matters:

One of the most difficult lessons I had to learn was that trading involves more than simply the technical aspects; it is also about mental power. You could have the best strategy, but if you can't control your emotions, it won't matter in the end.

Psychological impact:

The highs feel fantastic, but the lows may be terrible. The truth is that many traders fail not because they don't understand what they're doing, but because they don't know how to deal with the emotional toll.

Mastering the Mindset:

What distinguishes great traders from the rest is their ability to remain calm, stick to their strategy, and avoid making rash judgments. Honestly, this is what distinguishes you over time.

My Toughest Moments: Turning Struggles into Success

There were days when I wanted to give up. It can be exhausting to watch your investments fluctuate wildly, sometimes up and sometimes down. However, I've come to realize that this is something that every trader faces.

The idea is not to avoid losses; rather, to bounce back stronger each time.💪

Overcoming Fear of Loss

Losses are part of the process:

When I originally started, I considered every loss a failure. But now I understand that losses are unavoidable, and more importantly, they provide significant learning opportunities. Actually, long term successful traders are those that accept losses, learn from them, and move on.

Don't let emotions influence your actions:

The fear of losing money can cloud your judgment and lead you to make reckless decisions. It took me a long time to truly understand this, but once I did, it completely altered my approach. Staying calm, even while you're losing, can mean the difference between success and failure.

"We're Building This Together"

Success is more meaningful when we achieve it together, with each shared story and learned lesson. This is more than just trading knowledge it’s about building a supportive community where we can openly share advice, experiences, and encouragement.

Your story could truly encourage someone else who is struggling on their journey!

Remember, each of you brings unique value and respect to this community, and I’m really grateful to have you here. Let's keep learning, growing, and achieving success together. 🤝

Your shared experiences, with all their ups and downs, encourage us all.

Together We're not just a community; we're a family, always standing by each other.

Stay blessed

#stock market#cryptocurrency#financialfreedom#learntotrade#trading tips#hardworkpaysoff#stock trading#tradingskills#forex traders#trading success#traderlife#trading strategies#financialgrowth#tradingmotivation#day trading#trading psychology#investmentstrategies#entreprenuership#stockmarkettips#tradesmart#risk management#passive income

1 note

·

View note

Text

#day trading#futures trading#investing#investors#investments#finance#personal finance#financial literacy#volumeprofile#marketprofile#order flow#trader#stock market#emini

3 notes

·

View notes